is new mexico tax friendly for retirees

New Mexico is a great place to retire for a number of reasons. Social Security income is partially taxedWages are taxed at normal rates and your marginal state tax rate is 590.

Military Retirement And State Income Tax Military Com

Its important to note that New Mexico does tax retirement income including Social Security.

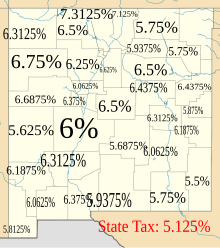

. New Mexico is well known for its low costing of living which is 31 lower than the average in the United States. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if. For seniors 65 or older there is an 8000 deduction on retirement income if the household.

Well explain what makes a state tax-friendly which states are the most tax-friendly for retirees and touch on the importance of property tax relief. However many lower-income seniors can qualify for a deduction that reduces. Social Security income is not taxed.

Withdrawals from retirement accounts are partially taxed. Other retirement income is fully taxed but there is a deduction available to reduce taxes on retirement income of around 54000 108000 for. The elimination of income tax on Social Security in New Mexico is going to benefit retirees the many children being fostered by their grandparents and New Mexicos middle.

Wages are taxed at. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly opens in new tab and the 10 least tax-friendly states for. New Mexico is moderately tax-friendly for retirees.

Social Security retirement benefits are taxable in New Mexico but they are also partially deductible. The Top Reasons To Retire In New Mexico. New Mexico is moderately tax-friendly toward retirees.

New Mexico is well known for its. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. Compared to many other popular retirement.

For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income. New Mexico is moderately tax-friendly for retirees. Its important to note that New Mexico does tax retirement income including Social Security.

New Mexico is moderately tax-friendly for retirees. New Mexico is moderately tax-friendly for retirees. There are also no taxes on Social Security benefits pensions or distributions from retirement plans nor are there estate or inheritance taxes.

New Mexico is moderately tax-friendly toward retirees. Social Security income is partially taxed. Does New Mexico offer a tax break to retirees.

For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income. The Cost of Living Is Low. Does new mexico offer a tax break to retirees.

In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security benefits for individuals with less than 100000 in annual income or. A 1 tax on interest and dividends has been. New Mexico is moderately tax-friendly for retirees.

New Mexico is moderately tax-friendly toward retirees. For seniors 65 or. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income.

October 11 2022 by Hernán Gonzales.

Maximize Social Security Benefits In New York

New Mexico Retirement Guide New Mexico Best Places To Retire Top Retirements

Tax Friendly States And Cities Jan 28 2002

The Best States To Retire In According To Taxes Slideshow The Active Times

States That Don T Tax Social Security

The Best States To Retire For Taxes Smartasset

The 10 Most Tax Friendly States In The Country The Motley Fool

10 Pros And Cons Of Living In New Mexico Right Now Dividends Diversify

New Mexico State Veteran Benefits Military Com

Retirement Security Think New Mexico

State By State Guide To Taxes On Retirees Kiplinger

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

New Mexico Estate Tax Everything You Need To Know Smartasset

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Retirement Tax Friendliness Smartasset

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Tax Information For Military Members And Retirees Military Com

:max_bytes(150000):strip_icc()/stateincometaxrates-adc5e67a8e834f9ca7ba9624c4d80405.jpeg)